BNPL - Regulation and Legacy

This week in Australia the Financial Services Minister, Stephen Jones put in motion the regulation of Buy Now, Pay Later (BNPL) in the market. The move announced by Mr. Jones will require BNPL providers to take into account more data when assessing new customers and require the providers to show that their products are suitable for customers under responsible lending obligations.

This is a move that has long been anticipated by many in the industry. The response has been interesting, with the inevitable slew of commentators jumping on the bandwagon of BNPL being bad for consumers and a slippery slope to indebtedness. Indeed, I have witnessed many in the industry celebrating the fall or withdrawal of BNPL brands here in Australia and across the globe.

I’d like to present some perspectives without getting emotional about brands.

BNPL gives customers what they want

When I look across the insight that we have at RFI and in our DBM Atlas data set, one thing becomes crystal clear. That is, when BNPL emerged, it presented consumers with a widely available option that they didn’t have before. The ability to choose – in the moment – to split a payment into tranches and pay them in a defined way had not existed as a mainstream option before.

And what did consumers think? They loved it. As much as any consumer can ever truly love a financial services product – we mustn’t get carried away here.

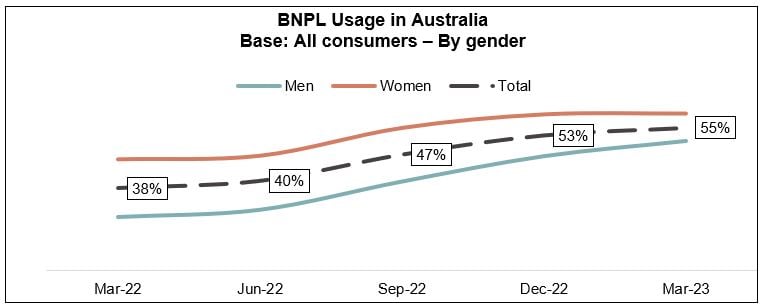

How do I measure this ‘love’? Let’s look at penetration and growth of penetration. What proportion of people use a BNPL product and how quickly did that proportion grow?

The latest RFI data suggests that 55% of all Australian adults have used BNPL. Given that the product didn’t really exist 6 or 7 years ago, this is phenomenal. There are only 3 financial services products with greater penetration in the populace – transaction accounts/ debit cards (~100%), savings accounts (70%) and credit cards (56%) are the only ones that trump BNPL on this metric. Yes, I know credit cards purchase volumes and values are way higher.

Furthermore, the penetration was growing rapidly even in 2022. In March 2022 38% of Australians had used BNPL, a figure that had risen to the current 55% by March 2023. An increase of 17% in 12 months is impressive.

Why has usage risen so rapidly? Because BNPL gives customers what they want. We regularly ask BNPL users why they like using it and the typical responses centre on:

- An ability to budget

- A way of avoiding interest payments

- A way to bring forward gratification

- Convenience

Those things are hard to argue with.

But it’s not for everyone

Now BNPL is not for everyone. I don’t use it. My wife doesn’t use it. And that’s ok. We prefer to use credit cards and chase reward points – which is also not for everyone. And that’s ok too.

My point here is that none of this means that BNPL is a bad product. We can choose to use it or not. And indeed many people choose not to use it. I can say this because our data shows that the vast majority of Australians are aware of at least one BNPL brand and the opportunity to use BNPL exists at (almost) every point of sale – physical or digital.

Specifically, RFI’s latest data suggests that 96% of Australian consumers are aware of at least one BNPL brand. This has held steady at 96% since September 2022 and has been above 90% since November 2020. EVERYONE, knows about BNPL, but “only” 55% of people have used it so far. 45% of people have not and it’s probably because they choose not to.

In fact, there is an argument, that the period of rapid growth is over and the large majority of the people that can use BNPL are already using BNPL. In March 2023, when we asked non-BNPL users if they were likely to use it in the next 12 months, just 4% of respondents described themselves as extremely likely to use it.

BNPL has made the incumbents innovate and offered choice

My final point here is that often innovation comes along which looks like it will change an industry, but ultimately fizzles out and dies. The product or service is ‘of the moment’, but it doesn’t leave a lasting legacy. Peer-to-peer lending is one such example – a revolution in lending, that was eventually underpinned by traditional funding sources.

Whether or not the original BNPL brands survive under new regulatory obligations remains to be seen. However, one thing is clear. They have changed an entire industry. It is not easy to get some of the world’s largest brands – Apple, PayPal – as well as the some of the country’s leading banks – CBA, NAB, Suncorp – to move to launch new products. And yet they have.

What to take away

1.Simply put. There are products that exist in the market today, that would not have existed, were it not for the threat to the traditional banking model that BNPL presented.

2.Outside of banking, BNPL has fundamentally changed the retail landscape. Our point-of-sale experience now offers options that did not exist just a few years ago. These options will endure, regardless of the brands that are underlying them.

3.As for consumers. They have more choice. The choice to use or not use BNPL. An alternative to borrowing with a personal loan or a credit card. The option to check out with or without traditional mechanisms when in store or online.

None of this is bad. So when I think about regulation, rather than looking on it as a crack down on risky practices and cheering from the side-lines when businesses scale back and people lose their jobs, I think of it as a recognition that BNPL is maturing into the mainstream and needs to be taken seriously.

Get in touch for more insights.

Subscribe to get the latest RFI data and insights.

About the Author

Alan Shields is the co-founder and a director at RFI Global, he oversees the design, roll-out and delivery of syndication and custom products to RFI Global’s clients globally. Alan has more than 20 years’ experience in research analysis and has spent his entire career focused on financial services across the globe including Europe, North America, the Middle East and Asia Pacific.

He has worked on syndicated and bespoke projects with every bank in Australia and New Zealand, with most major banks in the Asia Pacific region, as well as the major global banks. Prior to setting up RFI Global in 2006, Alan was Head of Financial Services – Asia Pacific at global research firm, Datamonitor, establishing Datamonitor’s financial services business in the Asia Pacific region in 2004, after relocating to Sydney from London. Alan began his career with Reuters in London as a financial services consultant, where he worked on the Nasdaq Europe project before moving to Singapore and focusing on wealth and risk management in the region. He is a regular speaker at thought leadership events across the US, Canada, Europe, Asia and Australia and authors regular articles on the latest global consumer banking trends.

He has a Bachelor of Science Degree in Physics from the University of Birmingham and studied his License de Physique at the Universite de Bordeaux I.

/NQA-ISO-27001-Logo-UKAS.jpg)